25 February 2025

How to Invoice as a Sole Trader: Your Step-by-Step Guide

8 minutes

When you first start out on your entrepreneurial journey, it’s not obvious how to invoice as a sole trader. While it’s an exciting milestone, it can feel daunting if you’re unsure what to include. The good news? Invoicing doesn’t have to be complicated. Once you know the essentials, it’s a straightforward process.

So, where do you start?

In this guide, we’ll walk you through the process step by step, so you can confidently create invoices and get paid hassle-free.

Here’s your step-by-step guide on how to invoice as a sole trader.

Can a sole trader give an invoice?

Yes. As a sole trader, you can (and absolutely should) issue invoices whenever you provide a product or service. An invoice acts as a record of the transaction, detailing what was provided, the cost and how the client can pay you.

Unlike limited companies, you don’t need to include a company registration number. But you do need to ensure your invoices meet legal requirements. This means including details such as your contact information, the client’s details and a clear breakdown of charges. Without a proper invoice, clients could delay payments or dispute the amount owed. If HMRC ever performs an audit on your business, they’ll ask for invoices alongside other financial records.

As well as peace of mind for your own business, most clients (especially larger companies), ask for invoices for their accounting. Sending a prompt and correctly formatted invoice enhances your business relationships and communicates that you’re professional, reliable and organised. So it’s a win all round.

What is an invoice?

Before we get into the details, let’s explain exactly what an invoice is. Simply put, an invoice is a document you send to a customer to request payment for goods or services you’ve provided. But it’s not just a receipt. It’s a legal document that needs to include specific details to be valid and make sure you get paid on time. These requirements are just as important for a sole trader as a multinational corporation.

So, how do you invoice for a beginner?

HMRC has specific rules for invoices, which means every invoice must include:

- A unique invoice number: A reference number to keep track of each invoice (e.g., 10040-56).

- Your details: Your name (or business name if you have one), postal address and contact information.

- Your customer’s details: The name and address of the person or company you're invoicing.

- A description of what you’re charging for: So your client knows exactly what they’re paying for.

- The supply date: The date you provided the goods or services.

- The invoice date: The date you created and sent the invoice.

- The amounts charged: A breakdown of the cost of each item or service.

- VAT details (if applicable): If you're VAT-registered, you must include the VAT amount.

- The total amount due: The full amount your client needs to pay.

Let’s break this down in more detail.

How do I create an invoice as a sole trader?

Creating an invoice as a sole trader doesn’t have to be complicated. But getting it right is key to getting paid on time. A clear, professional and accurate invoice not only helps you stay organised but reassures clients they’re dealing with a reliable partner.

Here’s a simple step-by-step process, covering everything you need to include and why each part matters.

-

Your details

Your invoice should always start with your personal or company details (as well as the word “invoice”), so your client knows exactly what it is and who it’s from. Make sure to include:

-

- Your full name (and business name, if you have one)

- Your business address

- Your phone number

- Your email address

- Your website (if applicable)

- A logo (optional, but adds a professional touch)

This information makes it easy for clients to contact you with questions and ensures they know who to pay. Logos, emails and websites aren’t essential, but they build a professional and memorable brand.

-

Your client’s details

Next, include the details of the person or company you’re invoicing. It’s important to get these right so the invoice reaches the right person and gets processed quickly. This should include:

-

- Their full name or company name

- Their business or personal address

- Their contact details (for instance, phone or email if available)

If you’re working with a larger company, double-check who should receive the invoice. For instance, sometimes it’s the accounts department rather than your direct contact. Getting these details right will save time in the long run.

-

Invoice number and date

Every invoice needs a unique number to keep track of payments and avoid confusion. You can use a numbering system like:

-

- 001, 002, 003... (simple and sequential)

- 2024-001, 2024-002... (including the year for clarity)

- INV-1001, INV-1002... (if you want a slightly more structured format)

You also need to include:

-

- The invoice date: when the invoice was issued

- The due date: when payment should be made (e.g., “Payment due within 14 days”)

This helps you and your client keep track of deadlines and avoid late payments.

-

Description of services or products

Be as clear as possible about the services or products you’re providing and the price you’re charging. A detailed breakdown reassures your client and makes it easier for them to approve payment.

If you’re providing more than one product or service (say, a clothes shop sending T-shirts, scarves and trousers in one order), itemise them on separate lines. If you’re a “service” business (for instance, a freelance IT contractor or a personal tutor) it’s good practice to include your hourly rate.

Here are a few examples.

-

- Too vague: Consulting work – £500

- More specific: 10 hours of website consultation and design updates (@£50 p/h) – £500

- Too vague: Illustrations – £300

- More specific: Custom invite illustration package, including 3 revisions – £300

- Too vague: Coffee - £50

- More specific:

- 1 x Dark Roast Arabica: Ground (300g) - £25

- 1 x Dark Roast Robusta: Whole Beans (300g) - £25

-

Payment terms

Spell out exactly how and when you expect the client to pay, to avoid any delays. Payment information usually appears at the bottom of the invoice.

As part of your invoice payment terms, you should include:

-

- Payment due date: e.g., “Payment due within 14 days of invoice date”

- Ways to pay you: for instance, bank payments, PayPal or cheque.

- Late payment penalties (if applicable): e.g., “A late fee of X% will be applied after 30 days”

In addition, it’s best practice to include your bank account details (or other payment details, like the address for cheques) directly on the invoice so your client doesn’t have to ask.

-

Total amount due

Make the final amount due stand out so there’s no confusion. With clear formatting, you reduce the chances of payment delays or back-and-forth emails clarifying the total. Again, it’s all about saving time (for both buyer and seller)—promoting a professional, reliable reputation.

This section should clearly show:

-

- Subtotal: the total before taxes.

- VAT (if applicable): if you’re VAT-registered, break this down separately.

- Any discounts or additional fees: if you’ve agreed on a discount or need to charge extra for late changes.

- Grand total: the final amount the client needs to pay. Remember to also include the currency. This is especially important if you’re dealing with international clients.

Do sole traders charge VAT on invoices?

As a self-employed sole trader, you only need to charge VAT on invoices if you’re VAT registered. So some sole traders charge VAT on invoices, and some don’t.

When do you have to register for VAT as a sole trader?

Whether you need to be VAT registered largely depends on your business turnover. If your turnover exceeds £90,000 in a 12-month period, or you expect it to in the next 30 days, you’ll need to register for VAT. If you’re not registered, you won’t charge VAT and your invoices will be simpler.

There are other cases where you must register for VAT, such as if your business is based outside the UK and you’re selling goods (or services to UK customers). Make sure to check government guidance for the latest legal requirements, and have a chat with a business accountant or legal advisor if you’re unsure.

How can a sole trader avoid VAT?

Even if your turnover exceeds £90,000, there are some VAT exceptions. For instance, you don’t need to register for VAT if you’re only selling VAT-exempt or “out of scope” goods and services. This includes certain financial services, educational courses and fundraising for charities.

If your annual turnover is below £90,000, you don’t have to register for VAT. That said, some sole traders choose to register voluntarily. It’s not mandatory, but registering lets you reclaim VAT on business expenses. The catch? There’s a bit more paperwork involved, like submitting regular VAT returns and including VAT information on your invoices.

So, how do you write a VAT invoice as a sole trader?

How do I write an invoice with VAT?

HMRC have an in-depth guide to charging, reclaiming and recording VAT for VAT registered businesses. But in terms of invoicing alone, you’ll need to include:

- Your VAT registration number.

- VAT rate, which is usually 20% in the UK, although there are exceptions.

- A breakdown of VAT applied to each item.

- The VAT total and the overall total (i.e. the full amount the client must pay).

If you’re not VAT-registered, simply don’t include VAT on your invoices. If you want, you can write “Not VAT registered” at the bottom to avoid confusion.

Sole trader invoice examples: VAT and Non-VAT registered

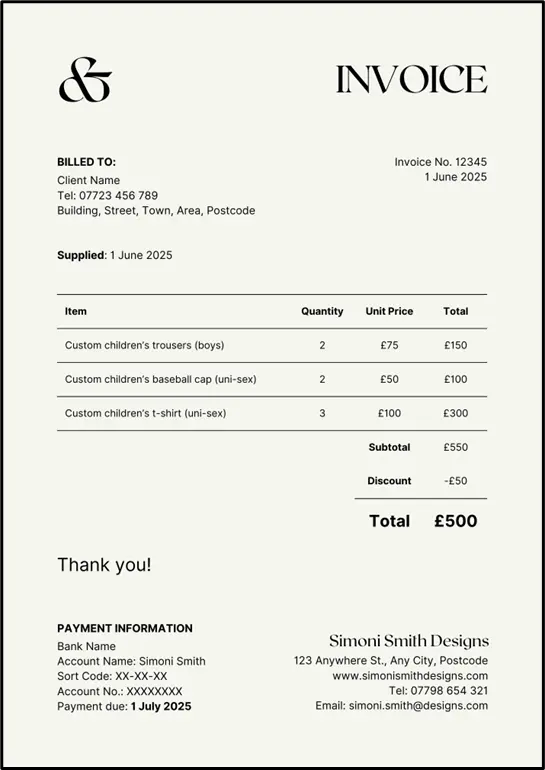

To understand what all this looks like in practice, here are two examples of a sole trader invoice. The first example is a “basic” sole trader invoice template, for a business that isn’t VAT registered. The second example has more detail, demonstrating what’s required for a VAT-registered sole trader.

Sole trader invoice example: Non-VAT registered

Invoicing as a sole trader: practical considerations

Once you’ve got the details for your invoice sorted, you’re almost there! The next step is creating and sending it out. Invoicing can feel like a lot to juggle at first, but with the right tools and a little organisation, it becomes much smoother. There are a few practical things to think about, like choosing the right software, tracking payments and handling follow-ups.

Here are a few aspects to bear in mind:

- Invoicing software

If you’re already using accounting apps (such as QuickBooks or Xero), you can simplify invoicing by creating invoices linked to your accounts. For a more bespoke approach, online tools (like Canva or Google Docs) offer free invoice templates, giving you full control over the look and layout of your invoices.

- Tracking invoices

It’s a great idea to track all the invoices you send by noting the invoice number, date sent, amount and date paid in a spreadsheet (or directly in your invoicing software). This helps you stay organised and prevents any confusion with clients. With specialised accounting software, you’ll also find automated tools for tracking which invoices are paid and sending custom reminders.

- Handling late payments

When payments are overdue, start with a polite email or phone call to remind the client. This is usually all that’s needed. But if a few follow-ups don’t do the trick, a formal notice should follow—with legal recourse as the final option. If late payments are a recurring issue, you could implement a late fee or set up payment plans.

In summary: invoicing as a sole trader in the UK

Invoicing as a sole trader is all about keeping things clear and professional. It’s an important part of maintaining good relations with clients, but proper invoicing is also a legal requirement.

Be sure to include your business details, the client’s info, a unique invoice number, a description of services and the total amount due. VAT-registered businesses must also add VAT details and any agreed payment terms, such as the due date and methods accepted. This ensures you get paid on time and helps keep everything organised for you and your clients.

At Howden Insurance, we offer specialist cover for all kinds of small businesses. For tailor-made and flexible policies, let us help you find the right cover to protect your business and the unique risks you face. Get in touch today and focus on what matters most—growing your business.