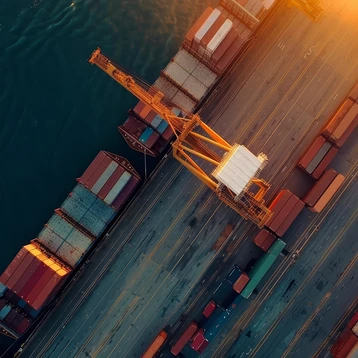

Freight Forwarders Insurance

Covers your freight business against contractual loss or damage to your clients goods while in your care.

Why choose Howden for your Freight Forwarders Liability Insurance?

Howden is the new name for Primo.

Finding the right liability insurance for your freight forwarding business can be challenging, but Howden makes it more accessible. With access to a vast network of leading insurers specialising in logistics, we can quickly source and compare policies, helping you find the best protection for your business. We aim to simplify the process, allowing you to concentrate on the efficient movement of goods rather than the intricacies of insurance.

We understand that no two freight forwarders operate the same way, so we offer a customised approach. Whether you need extensive coverage for multiple transport modes or a more specific policy for international freight, we work closely with you to design a solution that aligns with your particular risks and operations.

At Howden, we’re dedicated to supporting your business at every stage—whether you're arranging new cover, renewing a policy, or dealing with a claim. We focus on giving you confidence so you can keep delivering excellent service to your clients, knowing that your insurance is in capable hands.

Benefits of working with Howden:

- You can trust us – we’re rated Excellent on Trustpilot.

- Our brokers are well-versed in the nuances of the karting industry.

- We'll work with you to create a bespoke insurance package that meets your unique needs and budget.

- We leverage our relationships with top UK insurers to secure the best rates for our clients.

- Our dedicated team is committed to providing exceptional service.

What is Freight Forwarders Liability Insurance?

Freight liability insurance is a critical protection for businesses in the logistics sector, including UK carriers and bailees, such as hauliers, couriers, freight forwarders, and warehouse owners. This type of insurance covers your business against loss or damage to your clients' goods while in your care, custody, or control, and ensures that you are financially protected should a claim arise. Given the complex nature of modern supply chains, the need for comprehensive freight liability insurance has never been greater.

For businesses involved in transporting, storing, or handling goods, the risk of being held liable for damages or losses is ever-present. These risks could arise from a range of incidents, from accidents during transit to unforeseen issues such as theft, fire, or natural disasters.

Freight liability insurance ensures that, in the event of such incidents, your business does not bear the full financial burden of compensating for lost or damaged goods. This is particularly important for businesses that handle high-value goods or operate in industries with tight margins, where a single claim could have significant financial implications.

How does Freight Forwarders Liability Insurance work?

Freight Forwarders' Liability Insurance is designed to protect businesses involved in the logistics of transporting goods from one location to another. As a freight forwarder, your responsibility is to ensure the safe transit of goods, whether by road, rail, sea, or air. However, during the course of your operations, you may become liable for various types of loss or damage to cargo. This could result from negligent handling, improper storage, or damage that occurs while the goods are in transit.

Freight forwarders’ liability insurance provides coverage for these liabilities, ensuring that any claims made against your business for loss or damage to cargo can be dealt with without putting your company’s financial stability at risk. This type of policy is typically tailored to cover specific risks associated with logistics operations, including:

- Accidental damage to goods in transit, which may occur due to collisions, mishandling, or other unforeseen events.

- Loss of goods while in your care, whether due to theft, fire, or natural disasters.

- Legal liability for failing to meet contractual obligations in relation to the safe delivery of goods.

- Costs associated with delay in delivery or failure to meet specific delivery deadlines (depending on the terms of the policy).

By obtaining freight forwarders’ liability insurance, you protect your business against the potential for significant claims, ensuring that you can continue to operate without disruption in the event of an incident. Policies are typically customised to meet the specific needs of your business, whether you focus on national or international freight, or handle goods by sea, land, or air.

How does Freight Forwarders' Liability Insurance differ from Marine Cargo Insurance?

One of the most common areas of confusion within the logistics sector is the distinction between freight forwarders’ liability insurance and marine cargo insurance. While both types of insurance relate to the transportation of goods, they serve different purposes and are typically held by different parties within the supply chain.

Marine cargo insurance is generally obtained by the owner of the cargo and is designed to protect the goods themselves against physical loss or damage during transit, particularly when transported by sea. It covers risks such as theft, damage due to weather conditions, and sinking or capsizing of the vessel. Marine cargo insurance is essentially a "first-party" insurance policy, protecting the goods owner’s financial interest in the cargo.

In contrast, freight forwarders’ liability insurance is a "third-party" insurance policy. It is held by the freight forwarder or logistics provider to cover their liability in case the goods under their care are lost or damaged due to negligence or unforeseen circumstances. The forwarder does not typically own the goods but is responsible for their safe transit and delivery. This type of insurance provides coverage for the liabilities that may arise as a result of contractual obligations or general liability law.

It is important to note that while some freight forwarders’ liability policies may include limited coverage for cargo, this is usually secondary to the main focus of the policy: protecting the freight forwarder from liabilities. Cargo owners should still have their own marine cargo insurance to ensure comprehensive coverage of their goods. At Howden, our team can help you navigate these complexities and ensure that your business is adequately covered in all areas.

The Importance of Freight Liability Insurance for Logistics Businesses

Logistics businesses, including freight forwarders, haulage contractors, and warehousekeepers, operate in a sector where risks are ever-present. From potential accidents during transport to risks associated with handling and storage, these businesses must be prepared for any eventuality. Freight liability insurance provides crucial protection, ensuring that businesses are not left financially vulnerable when things go wrong.

For example, a haulier transporting goods across the UK may encounter accidents due to poor weather conditions or road hazards, leading to damage or loss of goods. Without freight liability insurance, the haulier may be required to cover the cost of replacing the damaged goods, resulting in significant financial strain. Similarly, warehouse keepers could face claims if stored goods are damaged due to fire, flooding, or mishandling.

Freight liability insurance not only provides coverage for direct losses but also helps safeguard your business’s reputation. In the competitive logistics industry, clients need assurance that their goods are in safe hands. By having comprehensive insurance in place, you demonstrate a commitment to professionalism and reliability, enhancing your business’s credibility in the marketplace.

Understanding Policy Variations and Exclusions

Not all freight liability insurance policies are created equal. There can be significant variations between policies, particularly in terms of exclusions and the extent of coverage. It is crucial to understand these variations to ensure that you are not left exposed in the event of a claim.

Common exclusions in freight liability policies may include:

- Acts of terrorism or war, which may not be covered under standard policies.

- Insufficient packaging or failure to adhere to packaging standards, which can invalidate claims related to damage.

- Losses related to deliberate misconduct by employees or contractors.

- Certain high-value or hazardous goods, which may require additional specialised coverage.

At Howden, we work closely with a range of insurers to ensure that you receive a policy tailored to your specific business needs. Our experienced brokers take the time to understand the unique risks associated with your operations and find solutions that provide comprehensive coverage, ensuring peace of mind for both you and your clients.

Contact Howden today to speak to one of our expert brokers and discover how we can help protect your business with freight liability insurance.

FAQs about Freight Forwarders Liability Insurance

What is freight forwarder liability insurance?

Freight forwarder liability insurance is a type of insurance cover designed to protect freight forwarders in the UK against potential liabilities arising from their operations, such as loss, damage, or cargo theft.

What are the main types of liability covered under freight forwarder liability insurance?

The main types of liability covered include loss or damage to cargo during transportation, errors in documentation or customs declarations, and third-party liability for injuries or property damage caused during the shipping process.

Are freight forwarders in the UK legally required to have liability insurance?

Yes, in most cases, freight forwarders in the UK must have liability insurance as part of their licensing and regulatory obligations.

What is the significance of liability insurance for freight forwarders in international trade?

Liability insurance is crucial for freight forwarders involved in international trade as it provides financial protection against potential losses or legal claims, which can arise due to various risks inherent in global shipping operations.

What are the key components of a typical freight forwarder liability insurance policy in the UK?

A typical policy may include cover for cargo loss or damage, errors and omissions liability, legal defence costs, and third-party liability for bodily injury or property damage.

How do insurance premiums for freight forwarder liability insurance in the UK usually get calculated?

Premiums are typically calculated based on factors such as the volume and value of shipments handled, the types of cargo transported, the geographic regions covered, the freight forwarder's past claims history, and the required cover limits.

What are some common exclusions in freight forwarder liability insurance policies?

Typical exclusions may include losses due to war or political instability, deliberate misconduct or illegal activities, normal wear and tear of cargo, and certain high-risk cargo types such as perishable goods or hazardous materials.

Can freight forwarders in the UK customize their liability insurance coverage based on their specific needs?

Yes, freight forwarders can often tailor their insurance coverage to suit their specific operations, such as adding coverage for specific types of cargo, extending coverage to certain geographical areas, or increasing coverage limits.

How does freight forwarder liability insurance protect against claims of errors and omissions?

The insurance covers legal expenses and damages resulting from errors or omissions in documentation, customs filings, or other administrative tasks related to the shipment process.

What role does liability insurance play in protecting freight forwarders from cyber risks?

Liability insurance can include coverage for cyber risks, such as data breaches or cyberattacks, that may compromise sensitive shipment information or disrupt operations, providing financial protection and support for recovery efforts.

More Resources

Articles about running a small business

Read any of the articles below to learn more about going self-employed, or starting and running your own small business:

Day-to-day running your business

- Running a business from home: Council rules in the UK

- Is your business ‘outstanding’?

- Turn business challenges into triumphs

- How does diversity help your business grow?

- Minimum wage rise - good or bad news for small businesses?

- What is the UK tax return deadline?

- New legislation impacting your business

- What is Employment Allowance UK?

- VAT return: all the information you need

- 21 of the smartest van storage ideas

- Do I need business insurance?

Starting your own business

- Business insurance brokers: what are they and how can they help?

- How to trade mark a name in the UK

- What’s on the HMRC starter checklist?

- Small Business Grants to Be Aware of in the UK

- How to Register a Name for a Business in the UK

- What to know about your business tax account (HMRC)

- Types of Business Insurance You Should Know About

- What business insurance do I need?

- How to Invoice as a Sole Trader: Your Step-by-Step Guide

- Sole Trader Advantages & Disadvantages

- What is a sole trader in the UK?

- How to register for VAT in the UK

Self-employed professionals

Latest guides on business terminology, documents and formulas

There are so many business documents, formulas and terminology that need to be considered when operating a business. Here are some guides on key aspects of business:

Business calculations & formulas

- Margin of safety: formula, and more

- How to Calculate Turnover for Your Company

- Gearing ratio: what to know for your business

- How to calculate VAT: A complete guide

- Working capital: formula, plus more

- Cost of sales formula: how to calculate CoS

- Cost of goods sold: formula and more

- How to value a business: step-by-step guide

Business jargon

- CapEx vs OpEx: What’s the difference?

- What is the domestic reverse charge?

- Per diem: meaning, examples, and more

- What is Turnover in Business? A Complete Guide

- What to Know About Return on Capital Employed (ROCE)

- What is PAYE? All the info you need

- What is Employment Allowance UK?

- Markup vs margin: what’s the difference?

- How much is a damp proof course?

- What is a holding company?

- What is Capital Expenditure in Business?

- What is a PO number?

- What is operating profit?

- Salary advance: key info for employers

- What is equity in business?

- Non-current assets: your guide to the key info

- What is a breach of confidentiality?

Business documents

Guides about business liability insurance

Making sure your business is covered with the right liability insurance is crucial – whether it be public liability, employers liability, professional indemnity insurance, or something more specific.

Read up on how different types of liability insurance work by reading any of the articles below:

- Is public liability insurance compulsory?

- The Difference Between Employee & Public Liability Insurance

- What is Public Liability Insurance? (Full Guide)

- All you need to know about public and product liability insurance

- What’s the average employers’ liability insurance cost?

- How Much is Public Liability Insurance?

- Public Liability Insurance Certificate: All You Need to Know

- Why now is the time to take out Public Liability

- What is Employers’ Liability Insurance?

- What is Professional Indemnity Insurance? Your Complete Guide

- What is Errors and Omissions Insurance?

Other guides about specific small businesses

Interested to learn more about specific small businesses and professions? Find out more in any of latest business guides below:

- Insurance for takeaway businesses

- How to Start a Cleaning Business: 7 Steps to Take

- Run a vaping shop? Make sure your business is protected

- Built to last: insurance essentials for joinery businesses

- How to Become a Carpenter in the UK

- Mitigating flood risk for printing businesses

- Accounts payable: what you need to know

Market Traders' Insurance

The right business insurance for market traders

Market stall owners need insurance too - and we're here to help.

Limited Company Insurance

Insurance that's tailor-made for limited companies

Don't leave your limited company unprotected - trust us to help you find the right insurance.

Gas Engineer Insurance

Insurance that ticks all the boxes for gas engineers

Let us help you find the right insurance for your gas engineering business.

Marine Cargo Insurance

Trusted marine cargo insurance from experienced brokers.

Navigate the seas of international trade with a comprehensive insurance policy that ticks all your boxes.