10 April 2025

2025: A vintage year for luxury watches

6 minutes

In this discussion with Charles Tearle, Head of Watches at international auction house Lyon & Turnbull, Howden’s Joshua Meadowcroft explores how the next generation is turning to vintage watches and the important considerations when it comes to insurance.

I'm very confident for 2025. Over the past two decades people were saying ‘the wristwatch is dead’ because the next generation has so much information on smartphones and smartwatches – but it’s gone completely the other way.

People surrounded by tech are instead looking at personal, intrinsically interesting watches, perhaps a luxury classic.

Back in the late 1960s, Cartier London made a watch called Crash, which looked as if it was inspired by Surrealist artist Salvador Dali’s ‘The Persistence of Memory’ melting clock. Cartier sold it as a variation of their best-selling oval-cased watch, the Baignoire. Crash watches were handmade and very few were produced.

At the time, Crash watches cost into the thousands but there was little demand. Now, if I had one from the late 1960s in auction today, I would expect it to make in the region of £1 million.

In 1991, a limited edition of Cartier Crash watches were made and they sold at around £25,000 each and stayed at that sort of figure for decades. Now that 1991 model would be £250,000.

American rapper and songwriter Kanye West wears a Cartier Crash and that is creating more interest. His 1991 ‘Paris’ re-edition, from a limited edition of 400, has a slightly smaller case than the original London version.

I also noticed that Facebook founder Mark Zuckerberg has a phenomenal watch collection which he’s built up only over the last year. Among the watches he has been seen wearing is a vintage 18-carat yellow gold Rolex Daytona Cosmograph ref 6239, known as the Paul Newman. That’s a real change as the Silicon Valley tech crowd didn't wear watches and that was across the board. So, yes, we are generally seeing a much younger generation coming to buy watches.

There are two types of buyers for vintage watches; those who want exceptional, 95 percent condition watches that will be put in a safe for an investment, and those who want to wear their watch and so don't have to buy something that's absolutely perfect.

Buyers should remember there’s no point in buying something absolutely pristine if they intend wearing it as the watch will scratch and then be no longer pristine.

Everyone has a dream

Buying vintage watches is an aspirational thing. A lot of people of a certain generation will want something that they aspired to as a teenager or their parents aspired to or owned.

For me, it was always Magnum Ferrari cars. If I won the lottery tomorrow I wouldn't want a new Ferrari, I would want that Magnum Ferrari because it was the car I aspired to own when I was a teenager.

So, when you go back to, say watches from the 1950s, 60s and 70s, buyers get tremendous pleasure from that era. They also can get good value, high quality and variation in terms of how that watch has survived over the years.

This is where Cartier tends to be the big one in the vintage watch world. It has become incredibly popular because it has always been something that people aspired to own but couldn't – an elegant, luxury classic. The watches are a smaller size and that has come back into vogue for men and women.

Certainly the younger generation have gone back to a slightly more elegant look where men and women are wearing the same watches.

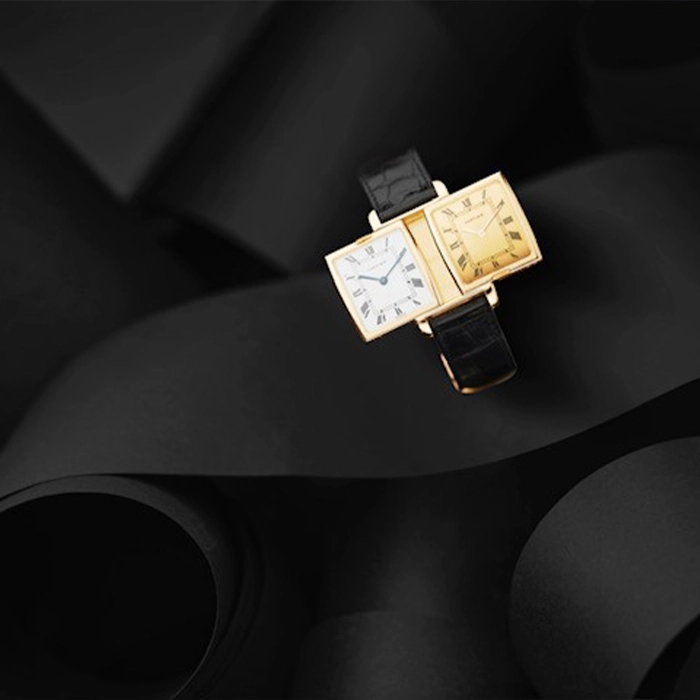

In our Cartier Curated auction on April 29, 2025 we have an early 1970s’ Cartier 18k gold reversible wristwatch. It has two movements with two dials so it’s like a dual time zone, but actually it uses two separate movements. It's incredibly rare and the estimate price is £25,000-£30,000. The sale coincides with a major exhibition at the V&A Museum in London that charts the evolution of Cartier's legacy of art, design and craftsmanship since the turn of the 20th century.

|

(Image: Rare Early 1070’2 Cartier 18k gold reversible wristwatch with an estimated price of £25,00 - £30,000) |

Every watch tells a story

Vintage watches often have interesting stories which appeal to collectors. Recently I came across an unusual watch by Dent. It had been bought by a man who had fought in the Boer War. He came home to be a schoolteacher, bought the wristwatch and then went off to fight in the First World War.

The First World War actually changed the whole watch market. Prior to that, the idea of a man wearing a piece of jewellery was looked down upon but the war proved how versatile and essential it was to have a watch on your wrist. It changed the whole market. The watch was found in a drawer by the deceased’s family who had no idea the watch even existed. It sold for £2,520.

|

|

I also had a phenomenal Chinese market pocket watch which was made around 1820 by Ilbery, London, an important maker of the period. It was in incredible condition with no damage to the central enamel scene. It was put into auction with an estimate of £10,000-15,000 and made, including buyer’s premium, £50,200. I love hearing people’s stories and then trying to get the best result possible for them. That’s why I love the vintage market so much. It's a win-win for everyone really. It means that the buyer gets a genuine, honest looked-after watch. We get to facilitate being the middle-man and the seller makes a return. We’re part of the journey. |

|

(Image: Charles Tearle during a Lyon & Turnbull auction) |

Buy with the heartMy best advice is the classic line in this business – ‘always buy the seller’. If you go to somewhere questionable, then there's a chance that you may lose your money. Pay a little bit more for peace of mind, always buy the seller. As for auctions, some people feel it can be quite an intimidating scenario but one of the great things is there's no hard sell. At auction, there is huge variety of pieces from modern, vintage, large, small, complicated, precious metal, stainless steel and you can try on everything and hone down to a preference rather than buying randomly. Go along, try on watches. Do not buy purely for investment. Buy because you love the watch and if it goes up in value you will be even happier. Watches are a very personal thing and you really want a watch what suits your lifestyle. Don’t follow trends. For example, the fashion for many years was large, oversized watches but these have now devalued. Obviously trying to predict the trends is no different to the stock market. That's what we try and do for a living! |

AUCTIONS DATES:

Cartier Created

Live auction April 29, 2025

London Watch live auction

Turnbull is now consigning for the May 22 London Watch live auction with viewing at 22 Connaught Street, London W2 2AF from May 18-21.

Visit lyonandturnbull.com

About Charles Tearle

Charles Tearle is an international watch specialist with more than 30 years’ experience in the global watch market. He joined Lyon & Turnbull as Head of Watches in 2024.

Charles started his career at a prestigious London retailer of vintage and antique watches in 1990. After working for over 10 years studying watches, Charles joined Bonham’s to establish a watch department in America. He went on to lead watch departments in New York and Hong Kong for Antiquorum and Sotheby’s before establishing himself as an independent consultant in rare watches.

As Head of Watches for Lyon & Turnbull, Charles is available nationwide to share his experience of watch auctions and valuations. His knowledge and passion covers a period of watchmaking from the 17th century to modern-day with a personal interest in watches from the 1950s and 1970s.

Contact Charles at charles.tearle@lyon&turnbull.com

Insuring a watch collection

When it comes to more expensive valuables, such as a luxury watch, a standard home insurance policy is unlikely to be suitable. Typically, there are low single article limits on jewellery and watches, so if the worst happens and a watch is stolen, in the event of a claim your client may not be fully covered unless the item is specified. And many standard insurers won’t cover more than £20,000 of jewellery and watches in total.

As a specialist broker we can help find policies with fewer restrictions and higher single article limits. Some of the insurers we work with will give a 25 even 50 per cent uplift for three years following a valuation, to protect policyholders from rising values.

To speak to Howden about insuring your watch collection, call 020 8256 4901 or email privateclients@howdeninsurance.co.uk